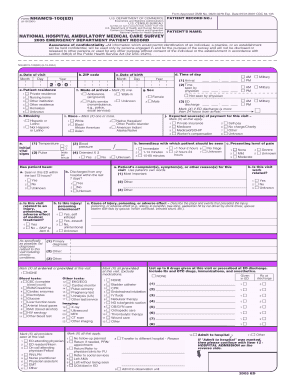

PH BIR 1701 Primer 2013-2026 free printable template

Show details

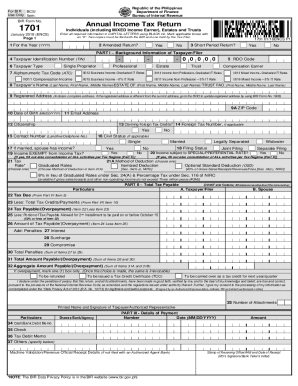

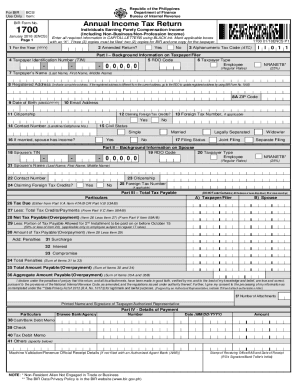

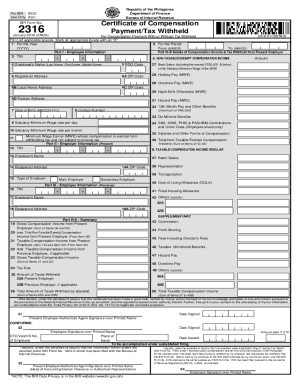

63C/D/E/F/G/H Regular Allowable Itemized incurred during the taxable year. This is the total amount reflected in the Mandatory Attachment to BIR Form No. 1701. BIR FORM 1701 PRIMER ANNUAL INCOME TAX RETURN FOR SELF-EMPLOYED/PROFESSIONALS ESTATES AND TRUSTS INCLUDING THOSE WITH BOTH BUSINESS AND COMPENSATION INCOME Individuals who are engaged in trade or business or the practice of profession including those mixed income earners i.e. those engaged in the trade/business or profession who are...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bir form 1701 download

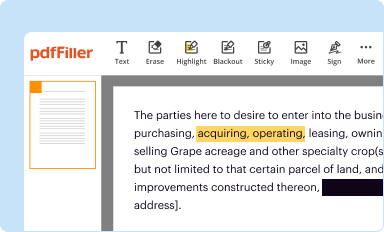

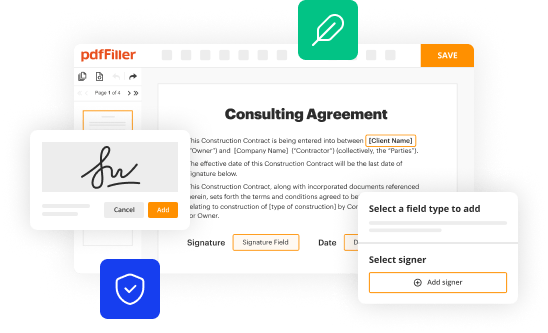

Edit your bir 1701 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your itr 1701 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 1701 bir form online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit bir 1701 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1701a bir form

How to fill out PH BIR 1701 Primer

01

Gather necessary documents such as income statements, receipts, and other relevant financial records.

02

Download the PH BIR 1701 form from the BIR website or obtain a physical copy from a BIR office.

03

Fill out the taxpayer information section, including your name, TIN, and address.

04

Indicate the type of income earned (e.g., self-employment, professional fees, etc.) in the appropriate fields.

05

Accurately report your gross income and deductions to calculate your taxable income.

06

Fill out the applicable tax rate and compute the total tax due.

07

Sign and date the form to certify that all information provided is true and correct.

08

Submit the completed form along with necessary attachments to the nearest BIR office before the deadline.

Who needs PH BIR 1701 Primer?

01

Self-employed individuals

02

Professionals earning income outside of regular employment

03

Partners in a partnership

04

Corporate officers receiving compensation

05

Filers needing to report annual income for tax purposes

Fill

bir form 1701a online filing

: Try Risk Free

What is bir form 1701?

BIR Form 1701, also known as Annual Income Tax Return for Self-Employed Individuals, Estates and Trusts is a tax form which summarizes all the transactions made over the tax calendar year.

People Also Ask about bir forms 1701

What is BIR Form 1701 in Philippines?

BIR Form No. 1701 shall be filed by individuals who are engaged in trade/business or the practice of profession including those with mixed income (i.e., those engaged in the trade/business or profession who are also earning compensation income) in ance with Sec. 51 of the Code, as amended.

What should I use 1701 and 1701A?

1701 is for those with mixed-income (eg. someone who is both a freelance writer and a teacher), while 1701A is for those whose income is only coming from his/her business or profession (eg. a full-time freelance writer or a bakery owner).

What is BIR Form 1701 quarterly?

BIR Form 1701Q, also known as Quarterly Income Tax Return For Self-Employed Individuals, Estates and Trusts (Including those with both Business and Compensation Income) is a tax return intended for professionals and self-employed individuals who are engaged in a sole proprietorship business.

What is BIR Form 1701 and 1701A?

The main difference between the forms is that BIR Form No. 1701 is for those with mixed-income (eg. someone who is both a freelance writer and a teacher), while 1701A is for those whose income is only coming from his/her business or profession (eg. a full-time freelance writer or a bakery owner).

What is the meaning of 1701?

What is this form? BIR Form 1701, also known as Annual Income Tax Return for Self-Employed Individuals, Estates and Trusts is a tax form which summarizes all the transactions made over the tax calendar year.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my bir 1701 annual income tax return in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your bir form 1701 annual income tax return and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I modify bir form 1701 online filing without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like taxable taxed earnings, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I complete form 1701 bir online?

With pdfFiller, you may easily complete and sign where to download bir forms online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

What is PH BIR 1701 Primer?

The PH BIR 1701 Primer is a guideline provided by the Bureau of Internal Revenue (BIR) in the Philippines that outlines the filing requirements and instructions for individuals engaged in trade or business.

Who is required to file PH BIR 1701 Primer?

Individuals earning income from self-employment, professionals, and those considered as mixed-income earners are required to file the PH BIR 1701.

How to fill out PH BIR 1701 Primer?

To fill out the PH BIR 1701, taxpayers should provide their personal information, income details, deductions, and compute the tax due based on the instructions provided in the primer.

What is the purpose of PH BIR 1701 Primer?

The purpose of the PH BIR 1701 Primer is to inform and guide taxpayers on how to properly report their income and compute their tax liabilities.

What information must be reported on PH BIR 1701 Primer?

The information that must be reported includes the taxpayer's name, address, taxpayer identification number (TIN), sources of income, deductions, and other relevant financial data.

Fill out your PH BIR 1701 Primer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bir Form 1701a Download is not the form you're looking for?Search for another form here.

Keywords relevant to 1701a form

Related to bir form 1701 version 2018

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.